MERCATOR is a five year (2020-2025) research project financed by an Advanced Grant from the European Research Council. The research explores the extent to which the memory of previous financial crises can explain practices threatening the stability of the financial system. The project stems from two simple questions: do financial actors have any knowledge, memory and understanding of previous financial crises? And, more generally, how far are they aware of the inherent instability of the financial system?

Surprisingly, these questions have never been asked before. Economic historians have paid no attention to memory, while cultural historians have shown no interest in financial crises. And yet they are hugely important to understand the causes of financial crises in general, and the Global Financial Crisis of 2008-9 in particular. In order to answer these questions, this project crosses for the first time two established areas, financial history and memory studies, which have never been combined before in a single study.

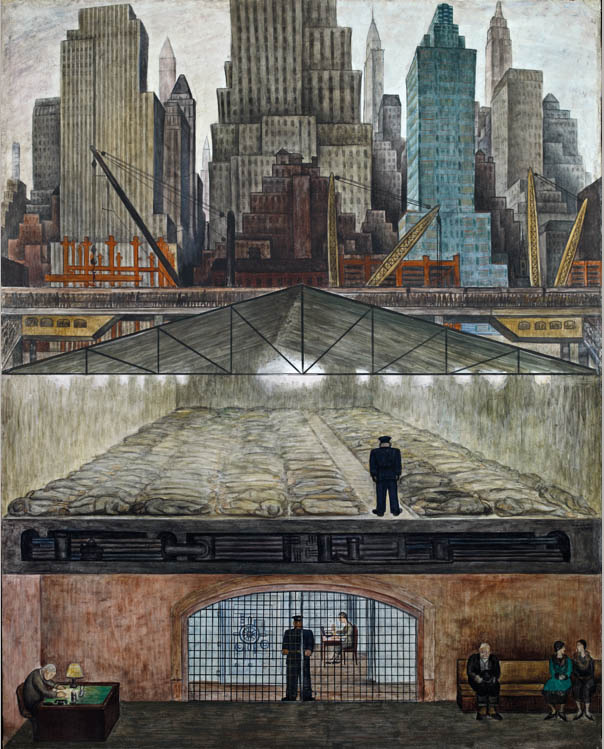

Frozen assets (1931)

The memory of four financial crises, the four most severe financial shocks of the last hundred years, will be analysed in the project: the long-term memory of the Financial Crises of the Great Depression of the 1930s; the medium-term memory of the International Debt Crises of 1982; the medium- to short-term memory of the Asian Financial Crisis of 1997; and the short-term memory of the Global Financial Crisis of 2008.

The Global Financial Crisis was arguably the most severe financial panic in modern history and led to the deepest economic downturn since the Great Depression. Many explanations have been given to this financial debacle, ranging from global imbalances and rising inequalities to highly complex and opaque financial products and the greed of bankers and financiers through the failure of regulation and the periodical outbreak of financial crises in capitalist economies. In addition to investigating the role played by memory, or the absence of memory, of previous crises as a cause of this debacle, this project will also consider its legacy: what is remembered from it more than a decade after its outbreak? What lessons have been drawn, if any? And how have these lessons been transmitted from one generation to the next?

The memory of financial crises will be analysed along five lines of inquiry:

- A vast oral history programme, with the interview of the leading financial actors both at the time of the outbreak of the subprime crisis (2007) and some fifteen years later.

- A prosopography of the financial elite in the late twentieth and early twenty-first century, to ascertain the extent to which a new financial elite emerged during this period and if so whether its members shared a new set of ethical values related, in particular, to making money and risking other people’s money

- A cultural memory of financial crises, based on the study of the media through which the memory of financial actors has been shaped from the Great Depression to the Global Financial Crisis, with particular attention to the financial press, as well as policy reports and analyses.

- An analysis of the emphasis given to financial crises in the teaching of economics and finance since the Second World War, and more generally in the education and training of future financial elites.

- An analysis of the role of memory in the process of regulation and deregulation since the end of the Second World War, including the use of memory for political purposes.

MERCATOR aims to reflect on how the Global Financial Crisis is remembered over a decade after the collapse of Lehman Brothers, when its memory is already fading and shifting, as well as being reconstructed and used by various interest groups, not least in the wake of the Covid-19 crisis. It also aims to propose a new vision of financial crises, focused on financial actors, and provide a missing link in the understanding of their recurrence.